Major UK banks are training their customers to fall for scams

"Never share your details when someone calls you" - unless, of course, it's us. This is the stance of many major UK banks, who warn their customers about phone scams while implementing practices that normalize responding to these calls.

| Bank | Where do they make unverifiable outbound calls |

|---|---|

| Lloyds, Halifax | Complaints process (source: website - see below). Don't allow you to hang up and call them back. |

| NatWest, RBS, Ulster Bank | Complaints process (source: personal experience). Don't allow you to hang up and call them back. |

| HSBC | Complaints process (source: personal experience). Don't allow you to hang up and call them back. On their website they falsely claim they don't do this. |

| First Direct | When making large transfers (source). Don't allow you to call them for this. |

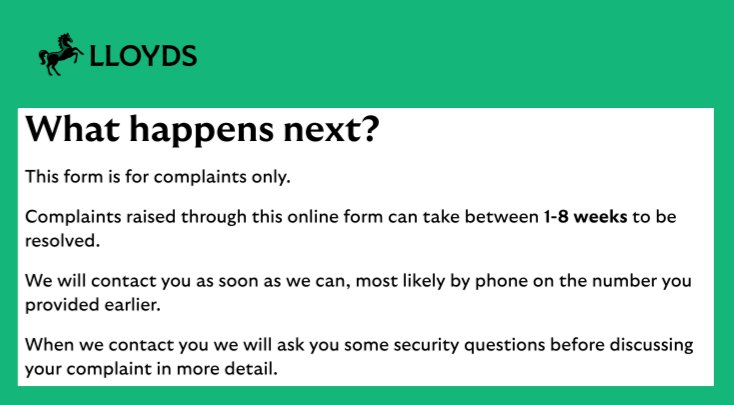

A prime example: Lloyds saying they'll call you sometime in the next 1-8 weeks and expect you to answer security questions.

However, there are a few banks who show it can be done well! These make calls possible to verify:

| Bank | Good practice |

|---|---|

| Barclays | Send you an app notification to confirm it's really them calling |

| Monzo | Call status indicators |

| Starling Bank1 Conflict of interest disclaimer: I used to work at Starling Bank. | Call status indicators, plus allow you to hang up and call them back |

Why This Matters

Every time a bank makes an genuine outbound call requesting security details, they're training their customers to:

- Trust unexpected callers

- Share security details over the phone

Some banks above support this for some functions, but not all. E.g. HSBC supports calling them back regarding fraud, but not regarding complaints.

This is great for scammers. After all, if real banks occasionally call and demand details, how are customers to know the difference between their bank and a scammer?

The Fix

It's simple: Banks should practice what they preach. No more unverifiable calls. If they need to get in touch, they should do so through their apps, or use something like a call status indicator or app notification to verify their identity.

Until then, they're part of the problem they claim to be fighting.